Amortization of assets calculation

Most countries define maximum amortisation rates or minimum number of years in which the amortisation of intangible assets can be deducted if at all. Amortization schedule showing 100 extra payments.

Amortization Of Intangible Assets Definition Examples

Many intangibles are amortized under Section 197 of the Internal Revenue Code which requires a 15-year amortization period.

. Amortization as a way of spreading business costs in accounting generally refers to intangible assets like a patent or copyright. Depreciation a non-cash expense referring to the gradual reduction in value of a companys assets. Operating Lease ROU Assets Must.

Assets and any income they earn accrue to the benefit of someone else who is not a member of the. Ownership shares in the mutual fund can be purchased or redeemed which is typically done at the end of each trading day. Return on Assets ROA is a type of return on investment ROI metric that measures the profitability of a business in relation to its total assetsThis ratio indicates how well a company is performing by comparing the profit its generating to the capital its invested in assetsThe higher the return the more productive and.

Example 1 Identification and Calculation of Total Fixed Assets. An identifiable intangible asset may be a patent trademark or license. It also refers to the spreading out.

Extra payments are not extra. The amortization summary and interest saved. ROA Formula Return on Assets Calculation.

A person has taken the auto loan of 200000 with the rate of interest 9 for the tenure of 3 years and he wants to prepare his amortization schedule. Amortization a non-cash expense referring to the cost of. This form is a tool to help the Seller calculate the income for a self-employed Borrower.

Loan amortization can be defined as. Goodwill amortization is permissible for private companies. The net asset value NAV commonly appears in the context of mutual funds as the metric serves as the basis for setting the mutual fund share price.

Read about capitalizing assets rules and policy. If there is a gain or loss on the difference between the expected and actual amount of return on plan assets recognize the difference in other comprehensive income in the period in which it occurs and amortize it to earnings using the following calculation. Amortization summary showing over 22000 in interest savings.

The difference using formula1 and formula 2 is because of some one-time expenses such as the acquisition of joint venture Joint Venture A joint venture is a commercial arrangement between two or more parties in which the parties pool their assets with the goal of performing a specific task and each party has joint ownership of the entity and is accountable for the costs losses. Hydra Enterprises is a proprietorship firm in the business of retail. The Enterprise Value EV EBITDA Multiple Calculation.

The amortization schedules summary header clearly shows you the amount of interest you will save by making extra payments. Using the above formulas in excel he gets amortization schedule. Maximum section 179 limitation calculation.

For intangibles the amortization schedule divides the value of the intangible assets over the assets useful life. The Sellers calculations must be based on the requirements and guidance for the determination of stable monthly income in Topic 5300. It purchased a store land building of 2000 sq.

Under Section 197 of US. But the trade-in value must be estimated and used in the calculation of depreciation the cost less the estimated salvage value should be depreciated over the three-year service life. Net Asset Value NAV and Mutual Funds.

In completing the asset income calculation the cash value of the asset is 60000 and the projected annual income from that asset is 3000. Form 91 is to be used to document the Sellers calculation of the income for a self-employed Borrower. Long-lived assets are generally categorized into three categories.

Read more amortization Amortization Amortization of Intangible Assets refers to the method by which the cost of the companys various intangible assets such as trademarks goodwill and patents is. Bonus depreciation is a special type of accelerated depreciation that you can take to write off most of the cost of depreciable business assets in the year they were first placed in service set up for use. Record the amortization of the ROU asset to the income statement.

If you arent familiar with the basic calculation of goodwill. This 100 deduction applies to assets with a recovery period of 20 years or less including machinery equipment and furniture. An example of the calculation of the right of use asset is as follows.

There is no interest expense recorded for an operating lease. When you dispose of a section 197 intangible any gain on the disposition up to the amount of allowable amortization is recaptured as ordinary income. The purpose of this accommodation is to reduce the.

Amortization is the paying off of debt with a fixed repayment schedule in regular installments over a period of time for example with a mortgage or a car loan. Right of Use Asset Example. Amortization is an accounting term that describes the change in value of intangible assets or financial instruments over time.

A note on terminology. Amortization is a broader term that is used for business intangibles as well as loans. Amortisation of intangible assets is not always tax deductible.

Just like with any other amortization payment schedules can be forecasted by a calculated amortization schedule. Businesses must report the total amount of amortization for each year on their tax returns using IRS Form. Loans for example will change in value depending on how much.

If multiple section 197 intangibles are disposed of in a. A non-identifiable intangible asset is mostly the goodwill of the company. Goodwill represents the excess of purchase price over the fair market value of a companys net assets.

Feet for 2 million to initiate its operations. NAV on a per-unit basis represents the price at which units ie. Its deductibility depends on the corporate income tax legislation of single countries.

Depreciation enables companies to generate revenue from their assets while only charging a fraction of the cost of the asset in use each year. Discover the difference between GAAP and tax accounting. The assets in each general asset account are depreciated as a single asset.

An amortization schedule that relates to the specific term and interest rate of the mortgage. Law the value of these assets can be deducted month-to-month or year-to-year. All these assets are prone to impairments.

Businesses can deduct the cost of these assets as expenses over several years using a process called amortization. Classify payments as operating activities in the statement of cash flows. Fixed asset accounting accuracy is critical given the large investment of fixed assets for most businesses.

The useful life for book amortization purposes is the assets economic life the expected period during which an asset is useful to the owner or its contractuallegal life the time until for example a patent or. Amortization applies to intangible assets with an identifiable useful lifethe denominator in the amortization formula. Repeat the same till last month and we will get amortization schedule.

Now we will see an example to prepare amortization schedule. However it works similarly in the case of loans but the payment structure is different. Yet another difference between amortization and depreciation is that the calculation of amortization does not usually incorporate any salvage value since an intangible asset is not typically considered to have any resale value once its useful life has expiredConversely a tangible asset may have some salvage value so this amount is more.

Amortization of prior service costs. A tangible asset includes property plant equipment etc. The EVEBITDA multiple ratio indicates to analysts MA professionals and financial advisors whether your company is.

Amortisation Double Entry Bookkeeping

.png)

What Is Amortisation Amortisation Meaning Ig Uk

Depreciation Depletion And Amortization Double Entry Bookkeeping

How To Amortize Assets 11 Steps With Pictures Wikihow

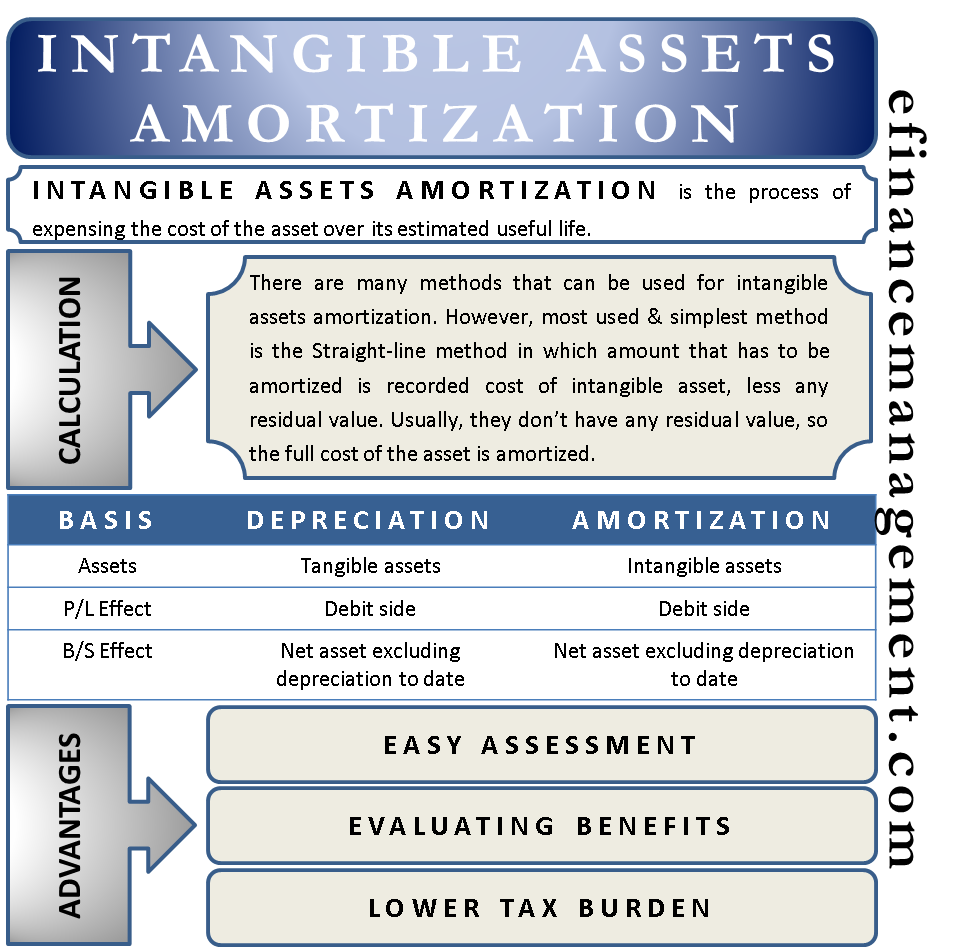

Intangible Assets Amortization All You Need To Know Efm

What Is Amortization Definition Formula Examples

Amortization Of Intangible Assets Formula And Calculator Excel Template

Amortization Of Intangible Assets Financiopedia

Amortization Of Intangible Assets Definition Examples

How To Calculate Amortization For Intangible Assets Universal Cpa Review

How To Amortize Assets 11 Steps With Pictures Wikihow

How To Calculate Amortization For Intangible Assets Universal Cpa Review

Amortization Of Intangible Assets Formula And Calculator Excel Template

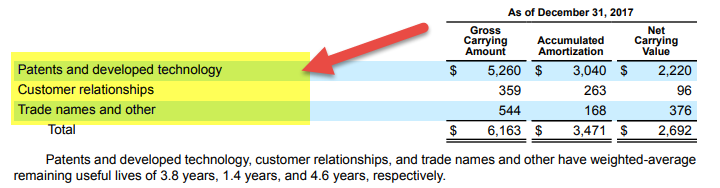

How To Calculate Amortization For Intangible Assets Universal Cpa Review

Amortization Of Intangible Assets Formula And Calculator Excel Template

What Is Amortization Bdc Ca

Amortization Options For Intangible Assets Valued Using The Income Approach Ds B