Calculate diminishing value depreciation rate

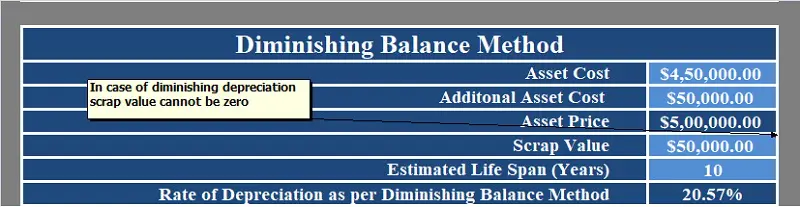

And if you want to calculate depreciation rate percentage manually then. Depreciation expenses Net Book Value Residual Value Depreciation Rate.

Depreciation Rate Calculator Sale Online 54 Off Www Ingeniovirtual Com

Then youll need to know the federal and state tax brackets you fall into.

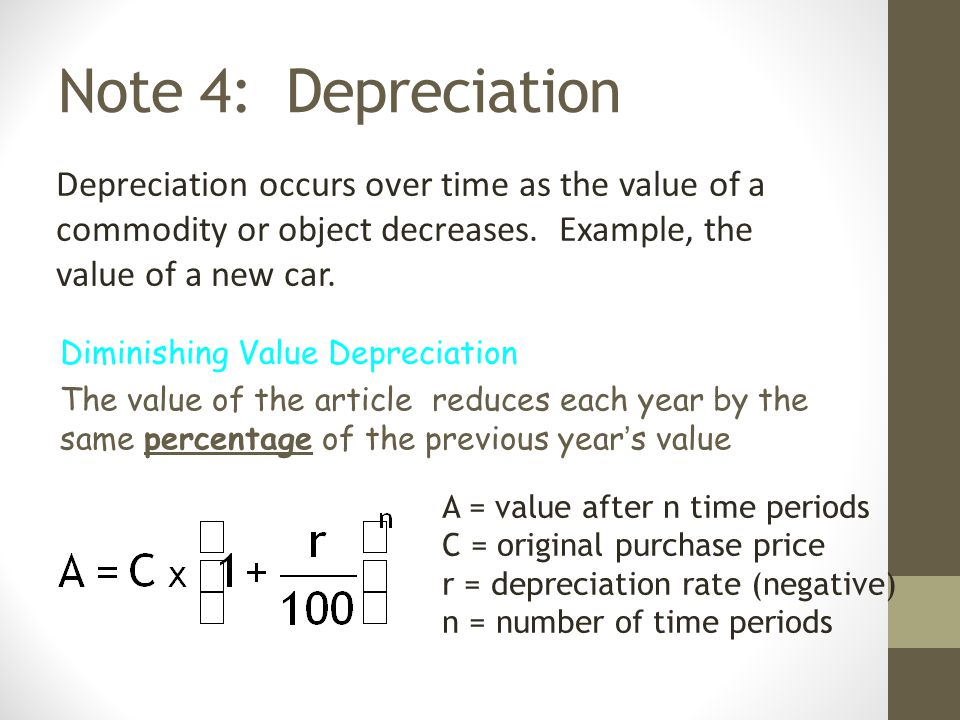

. Diminishing Value Depreciation Method. Hence using the diminishing method calculate the depreciation expenses. The straight line method SL.

However a fixed rate of depreciation is applied just as in case of straight line method. 1- scfrac1n X 100. Written Down Value Method Formula.

A declining balance method is a common depreciation-calculation system that involves applying the depreciation rate against the non-depreciated balance. There are 2 methods for depreciation. If an asset with a useful life of five years and a salvage value of 1000 costs you 10000 the total depreciation in the first year is 1800.

The amount youll use to calculate depreciation value will be 255000. Plugging these figures into the diminishing value depreciation rate formula gives the following depreciation expense. The difference in the value of accounting depreciation and economic depreciation should be adjusted from the capital employed.

2000 - 500 x 30 percent. Double Declining Balance Depreciation Example. Ensure you request for assistant if you cant find the section.

Rate of depreciation fracAmount of depreciationOriginal cost of asset x 100 Diminishing balance or Written down value or Reducing balance Method Under this method we charge a fixed percentage of depreciation on the reducing balance of the asset. For any items valued at less than 300 you can claim 100 of the value of the item immediately. You have to divide the number 1 by the number of years iover which you will depreciate your assets.

This perk is named after internal revenue code. Pages 550 words Approximate price. If you buy a computer that you expect to use for five years then all you need to divide 2 into 1 to attain a depreciation rate of 02 per year.

Calculate your essay price. The rate of depreciation is 60. These are expenses that do not affect the cash flow of a given period.

After filling out the order form you fill in the sign up details. Do you have an urgent order. Last Year Depreciation Rate 12-M12 x Depreciation Rate.

If an asset costs 50000 and has an effective life of 10 years your first years. Related Topic More Assets Related Questions and Answers How to Calculate Scrap Value of an Asset with WDV Depreciation. Prime cost straight line and diminishing value methods.

It represents the amount of value. The asset cost 2000 and youll be able to sell it for 500 when youre through with using it. Modern bookkeeping systems generally calculate depreciation but make.

It uses the rate of depreciation on the closing asset value of the asset. You can calculate the depreciation rate by dividing one by the number of years of useful lifean item with a useful life of five years has a 20 depreciation rate. Where s is the scrap value of the asset.

Effective life of an asset. Calculate depreciation for a business asset using either the diminishing value DV or straight line SL method. The template calculates the Rate of Depreciation applying the following formula.

Foreign exchange contracts are reported at fair value as on the reporting date. View the calculation of any gain or loss on sale on the disposal of an asset when appropriate. This lets us find the most appropriate writer for any type of assignment.

Declining Balance Method. 255000 x 24 61200 for federal. In Diminishing Method the scrap value cannot be 0.

Declining Balance Method Example. For this example well say your federal tax rate is 24 and your state tax rate is 7. When you are done the system will automatically calculate for you the amount you are expected to pay for your order depending on the details you give such as subject area number of pages urgency and academic level.

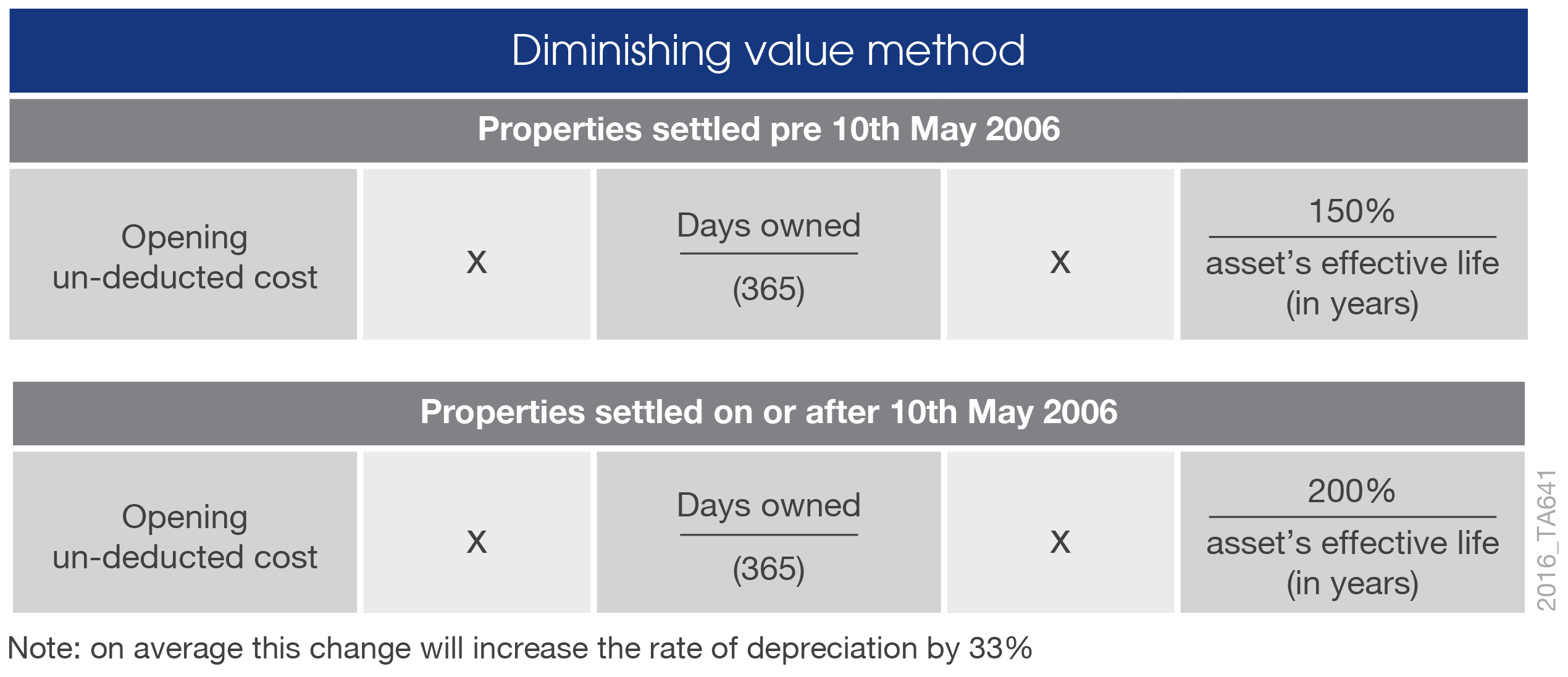

The diminishing value method DV This method depreciates at a high rate for the start of an assets life and has a reducing rate each year. A Every employee engaged on a piece-rate or regular hourly rate basis to labor on a farm shall effective January 1 2020 be paid not less than 1030 per hour or the minimum wage rate set by section 6a1 of the Federal Fair Labor Standards Act of 1938 29 USC. There are many related factors to this deduction category with the Section 179 deduction being one of the most helpful ones.

The value of the statement is as follows. Calculation of depreciation rate under diminishing balance method. Low-value assets pool.

First the actual decrease of fair value of an asset such as the decrease in value of factory equipment each year as it is used and wear and second the allocation in accounting statements of the original cost of the assets to periods in which the assets are used depreciation with the matching principle. The diminishing value formula is as follows. Simplified depreciation rules including instant asset write-off for small businesses with an aggregated turnover of less than 10 million from 1 July 2016.

More details on methods of depreciation can be found from the Vedantu site and app. And while following so in an academic project the students will still have to calculate the value of fixed assets. Net Book Value INR 500000 in the first year which is equal to the cost of the car.

To Calculate Scrap Value of an Asset Cost of Asset Total Depreciation. Export the calculation results to an Excel workbook. This is just like the diminishing balance method.

Along with our writing editing and proofreading skills we ensure you get real value for your money hence the reason we add these extra features to our homework help service at no extra cost. Thus depreciation is charged on the reduced value of the fixed asset in the beginning of the year under this method. Written Down or Diminishing Balance Method.

The rate of depreciation is 30 percent. After 9 years scrap value 100000 90000 10000. Suppose a photocopier has a useful life of three years.

Depreciation rate 1 useful life. The total depreciation you can claim over an assets life is the same for both methods. Multiply the amount you can depreciate by your tax rates as follows.

In accountancy depreciation refers to two aspects of the same concept. An asset for a business cost 1750000 will have a life of 10 years and the salvage value at the end of 10 years will be 10000. The results of this depreciation rate finder and calculator are based upon the.

In this method we apply a percentage on face value to calculate the Depreciation Expenses during the first year of its useful life. Work out diminishing value depreciation. Base value x days held 365 x 200 assets effective life Example.

Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. This rate of depreciation is twice the rate charged under straight line method. Lets understand the same with the help of examples.

First Year Depreciation Rate M12 x Depreciation Rate. Get your paper done in less than 4 hours. For the next of years we apply the same percentage on the booked of written down value of the asset but the value of the percentage is not given in the data we.

Depreciation is a vital tool that helps small businesses take significant deductions to lower tax billsDepreciation refers to the diminishing value of an asset like real estate vehicles and office equipment. 1 Scrap ValueAsset Value 1Life Span In the end the template displays the depreciation schedule for the diminishing balance method. Ram purchased a Machinery costing 11000 with a useful life of 10 years and a residual value Residual Value Residual value is the estimated scrap value of an asset at the end of its lease or useful life also known as the salvage value.

Note 4 Depreciation Depreciation Occurs Over Time As The Value Of A Commodity Or Object Decreases Example The Value Of A New Car Diminishing Value Ppt Video Online Download

Depreciation Formula Calculate Depreciation Expense

Download Depreciation Calculator Excel Template Exceldatapro

Depreciation Formula Examples With Excel Template

Diminishing Balance Method Of Calculating Depreciation Also Known As Reducing Balance Method Accounting Simpler Enjoy It

Diminishing Balance Depreciation Method Explanation Formula And Example Wikiaccounting

Prime Cost Vs Diminishing Value Depreciation Method Which Is Better Duo Tax Quantity Surveyors

Double Declining Balance Depreciation Calculator

Which Depreciation Method Is Best For You The Real Estate Conversation

Written Down Value Method Of Depreciation Calculation

Depreciation Formula Calculate Depreciation Expense

Depreciation Diminishing Value Method Youtube

Solved I M Trying To Calculate For The Diminishing Rate On Chegg Com

How To Use The Excel Db Function Exceljet

How To Calculate Depreciation Using The Reducing Balance Method Diminishing Balance Method Youtube

Straight Line Method Vs Diminishing Balance Method Depreciation Calculation Examples Youtube

Prime Cost Vs Diminishing Value Depreciation Method Which Is Better Duo Tax Quantity Surveyors